Iron – Western Australia

Economic Impact of Iron Ore Decline

The iron ore boom that has significantly bolstered both Western Australia and the national economy since the onset of the COVID-19 pandemic is now facing potential challenges. Recent warnings from both the WA and Federal Budgets indicate that the lucrative iron ore sector might soon encounter tough times.

Iron Ore’s Contribution to Government Surpluses

The windfall tax receipts from iron ore mining have been a cornerstone of the recent budget surpluses. Federal Treasurer Jim Chalmers has credited these receipts as a major factor in the consecutive surpluses. Similarly, royalties from iron ore have been a substantial contributor to the $23 billion combined surpluses recorded by Western Australia over the past six years.

Potential Risks and Slowdown Indicators

However, a slowdown in demand from China, a major consumer of iron ore, has raised concerns. The reduction in commodity prices, particularly iron ore, is identified as a significant risk to both state and federal budgets. Both the Commonwealth and WA governments have adopted conservative price assumptions, with the WA Budget projecting an average price of $US75 per tonne for 2024-25. Despite this, there is a trend of these estimates being surpassed.

Challenges in Forecasting Commodity Prices

Treasurers typically adopt cautious approaches when forecasting commodity prices, given the volatile nature of global markets and geopolitical uncertainties. While conservative estimates help manage budget risks, unexpected market fluctuations can create substantial budgetary gaps if prices deviate significantly from forecasts.

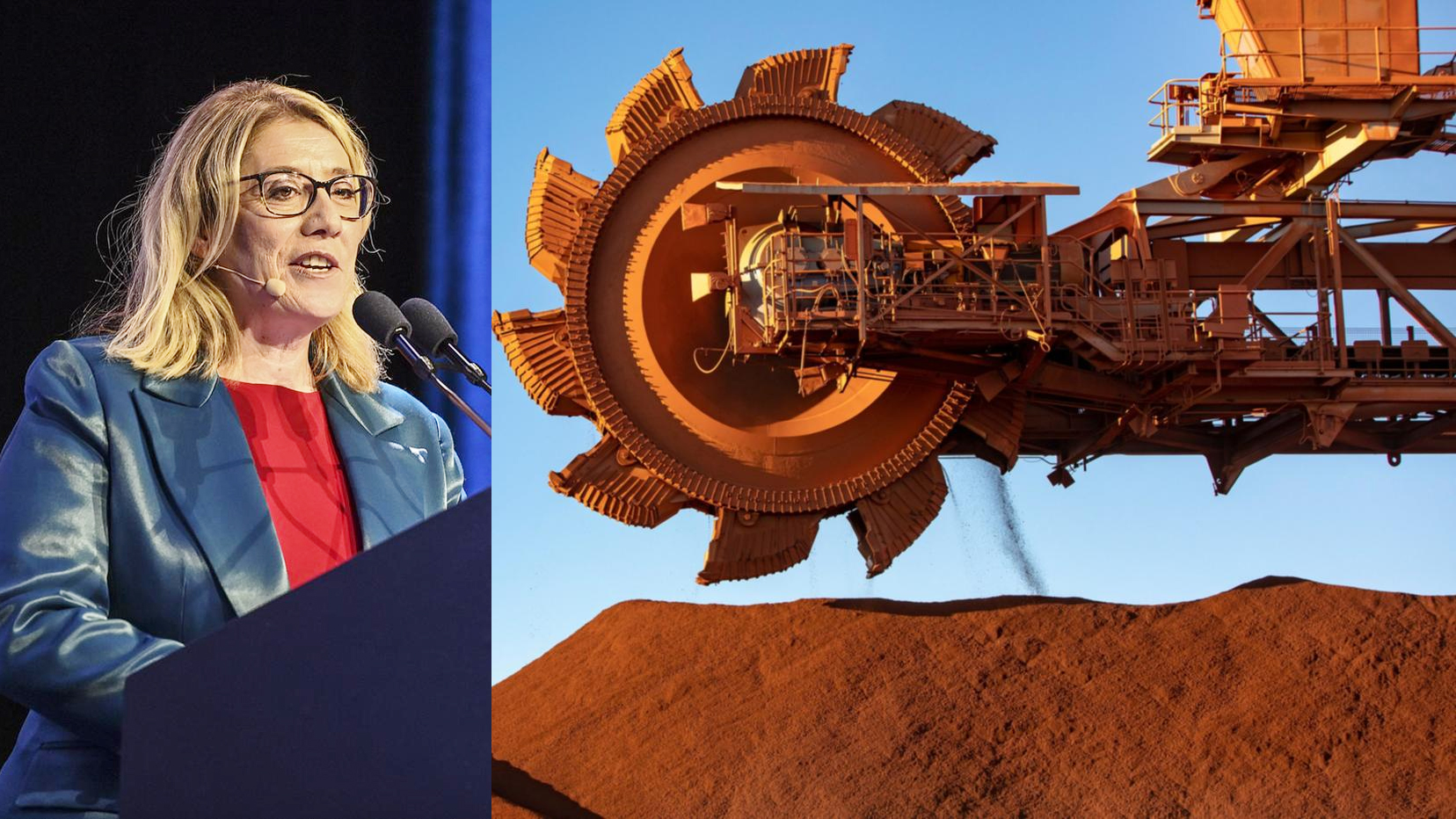

WA Treasurer’s Perspective

Despite the grim outlook reflected in the budget documents, WA Treasurer Rita Saffioti remains “cautiously optimistic” about iron ore prices. She acknowledged the inherent volatility of commodity markets, stating, “There’s a lot of volatility in relation to commodity prices, that’s why we budget conservatively.” Saffioti highlighted the numerous factors influencing commodity demand, including property markets and infrastructure needs.

Implications of Price Fluctuations

For every $US1 increase in the average annual iron ore price above the $US75/t assumption, WA stands to gain an additional $94 million in royalties. Conversely, any drop below this price could result in significant budget shortfalls. Currently, the iron ore price hovers around $US115/t, but a substantial decline could end a lucrative four-year period of bonus revenue for both state and federal governments.

Federal Budget Insights

The Federal Budget has noted that steel demand in China has likely peaked. A recovery in iron ore and metallurgical coal supply is putting downward pressure on prices. The budget report points out that while Chinese imports of iron ore reached record levels in 2023, driven by strong infrastructure investment and industrial expansion, the property sector’s weak demand and declining residential construction have led to a plateau in steel production.

WA Budget Forecasts

The WA Budget echoes these concerns, noting a decline in iron ore prices from $US144/t earlier in the year to $US100/t in April. The budget anticipates that Chinese steel demand will remain stagnant over the next six months and then moderate. Data from early 2023 shows significant declines in property sales and completions, further affecting steel and iron ore demand.

Counterbalancing Factors

While infrastructure investments and growth in Chinese steel-intensive manufacturing provide some support to iron ore prices, there are counteracting forces. Falling steel output in major production countries such as the US, Russia, and South Korea, along with rising iron ore production in Australia, Brazil, and West Africa, exert downward pressure on prices.

Future Projections

The WA Budget projects an increase in domestic iron ore production, with output expected to rise from 862 million tonnes in 2023-24 to 886 million tonnes in 2024-25. This increase is largely attributed to new production from projects like Fortescue’s Iron Bridge and Mineral Resources Limited’s Onslow project. Additionally, the Simandou project in Guinea, with significant investment from Rio Tinto, is expected to ramp up production over the next four years.

As the iron ore sector faces potential uncertainties, these developments underscore the need for careful monitoring and flexible economic planning.

Edited by Australia Today